The following infographic shows how liabilities differ from the owner’s equity. In comparison, the interest rate of liabilities is usually a fixed and pre-defined percentage that does not vary with the future business performance. Expense, until not paid off, is a liability in nature. The expense is a subset of liability in simple terms. An expense is always a liability to incur, and when it gets incurred, it is shown as a cash outflow from the cash flow and gets accrued in the income statement. In contrast, distributions to owners (e.g., dividends) are not treated as an expense and subtracted directly from equity.Īnother distinguishing feature between liabilities and equity is that the return on equity (e.g., dividends and capital gains) is primarily based on the business performance. Liabilities and expenses are cash outflow in the business. However, the cost of liabilities (e.g., interest expense on borrowing) is deducted in the income statement as a financing cost. Interest payments are usually tax-deductible, unlike payments to equity holders.įrom an accounting perspective, liabilities and equity balances are both shown on the credit side of the balance sheet.On a standard balance sheet, total assets are listed on the left side. Accrued expenses are usually current liabilities since the payments are generally due within one year from the transaction date. The expenses are recorded on an income statement, with a corresponding liability on the balance sheet.

liabilities to place a valuation on the company. Accrued expenses or liabilities occur when expenses take place before the cash is paid.

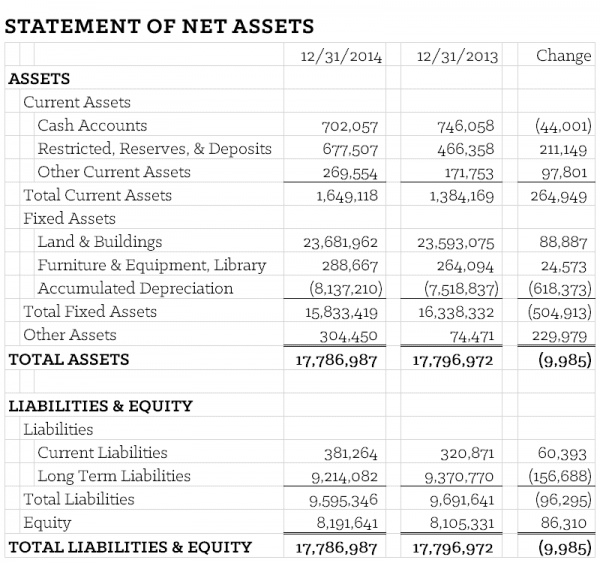

A standard accounting equation pits the total assets of a company against its total liabilities, and investors use this ratio of assets vs. It has a lower risk to lenders compared to equity. An asset is anything that your company owns that can be converted to cash or has the capacity to generate revenue. Assets represent a net gain in value, while liabilities represent a net loss in value.The reason businesses often use debt is that it is generally cheaper than raising equity because: Also, in case of bankruptcy, all liabilities of a business need to be repaid before any amount is returned to the owners. The main difference between the two is that the repayment of liabilities is required by law, unlike the repayment of equity which is discretionary.

0 kommentar(er)

0 kommentar(er)